Data analytics simply means analysing raw data to find patterns and trends and make informed business decisions. It has now become one of the crucial strategies of Business Intelligence. Businesses these days take advantage of the information derived from data around the globe to go up the ladder of success. Everything we see these days is data-driven information that is further processed and executed to achieve great results in business language, huge profits, and annual turnovers. Read further and see how data analytics contribute to business Intelligence strategies.

Descriptive and Diagnostic Analytics

Everything first begins by collecting data in bits, be it in a structured or unstructured form. The data is gained from internal and external sources such as databases, spreadsheets, social media, and IoT devices. After collecting varied data from various sources, it is cleansed, transformed, and prepared for analysis.

To understand better, take the example of SmartMart collecting data from its sales transactions, customer interactions, website visits, social media mentions, energy consumption, including the use of solar panels, and inventory levels. This data is then integrated into a centralized data warehouse for analysis.

Then, the gathered data is matched with its previous versions. It helps identify the possible reasons for the change to provide an overview of how the business has performed to date, and on these grounds, future strategies are framed.

Predictive and Prescriptive Analytics

As the title suggests, Predictive and Prescriptive Analytics show the potential results that would have taken place if certain actions had been taken or decisions had been made. The former term shows exactly what is going on, and the latter, prescriptive analytics, provides businesses with answers to what should be done.

For example, A retail chain notices that there is a sudden drop in sales at one of its stores. So when diagnostic analytics is used to investigate its causes, it revealed that road construction reduced the number of visits to their store and diverted traffic away.

Predictive and Prescriptive Analytics use data mining techniques, including statistical data modeling and machine learning, to predict future outcomes based on historical data.

- Data mining extracts insights from large datasets by discovering patterns and relationships.

- It involves preparing data, exploring it for understanding, and applying algorithms for analysis.

- Predictive modeling and classification tasks are used for forecasting and categorizing data.

- Results are evaluated, interpreted, and applied to various fields for decision-making and efficiency.

Every sector uses data mining techniques like the ones listed in the table below.

| Organization | Data Mining Use Cases | Tools/Techniques |

| Retail and E-commerce | Market Basket Analysis, Customer Segmentation | Apriori algorithm, K-means clustering |

| Finance and Banking | Fraud Detection, Credit Scoring | Logistic Regression, Decision Trees, Random Forests |

| Healthcare | Disease Prediction, Treatment Effectiveness Analysis | Support Vector Machines, Neural Networks |

| Telecommunications | Customer Churn Prediction, Network Optimization | Decision Trees, Neural Networks, k-nearest Neighbors |

| Manufacturing and Supply Chain | Predictive Maintenance, Demand Forecasting | Linear Regression, Time Series Analysis |

| Marketing and Advertising | Customer Sentiment Analysis, Campaign Optimization | Natural Language Processing, Sentiment Analysis, A/B Testing |

| Government and Public Sector | Crime Pattern Analysis, Fraud Detection | Association Rule Mining, Anomaly Detection |

| Education | Student Performance Analysis, Dropout Prediction | Decision Trees, Logistic Regression |

| Energy and Utilities | Predictive Maintenance, Energy Consumption Forecasting | Regression Analysis, Time Series Forecasting |

| Transportation and Logistics | Route Optimization, Supply Chain Visibility | Genetic Algorithms, Simulated Annealing |

Real-time Analytics and Performance Monitoring

There are many popular open-source real-time OLAP databases for real-time analytics and performance monitoring techniques. These real-time database analytics are done with the help of Apache Pinot, Apache Druid, and ClickHouse because of their ability to handle high-velocity, real-time data streams and provide low-latency access to insights.

Many financial institutions monitor key performance indicators (KPIs) such as customer acquisition cost and loan default rates in real-time to frame their marketing strategies by tracking KPIs and identifying areas for improvement.

Real-time analytics applies all the logic and maths on the data to feed updated insights into performance monitoring to track KPIs and detect deviations from expected performance levels. This makes it possible for businesses to adjust quickly to shifting circumstances and maximize performance instantly.

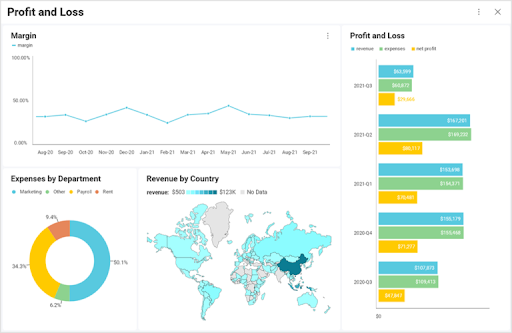

Data Visualization

After gathering all the relevant data, it is presented in a form that is understood by humans in simple graphic representations, be it graphs, charts, plots, infographics, or even animations.

This type of graphical presentation helps to tell stories by curating data into an easier form to understand, highlighting the trends and outliers. A good visualisation is about telling a story by removing unwanted data and highlighting useful information. Like an insurance company leverages predictive analytics to assess the risk of insuring different types of properties. By analyzing historical data on property damage claims, weather patterns, and geographic location, the company identifies areas prone to natural disasters and adjusts its pricing and coverage policies accordingly.

The tools available in the market to convert data into its visual form include

- Tableau

- Microsoft Power BI

- QlikView

- Google Data Studio

- Plotly

- D3.js

- Chart.js

- Excel

- Looker

- Grafana

Risk Management and Predictive Analytics

Risk management uses predictive analytics reports to mitigate risks. It is exactly like nipping the bud before it grows. Predictive analytics manages the risk by forecasting potential risks and vulnerabilities based on historical data. So by combining predictive analytics with risk management strategies, organisations can identify and mitigate risks before they escalate.

SmartMart uses data analytics to identify potential risks such as inventory shortages, market fluctuations, or cybersecurity threats. For example, they implement anomaly detection algorithms to highlight unusual patterns in sales data that could indicate fraudulent activities or operational issues. By proactively addressing these risks, SmartMart minimizes potential losses and maintains business continuity.

Let us take a closer look at one popular example of risk management set by JPMorgan Chase. It is one of the largest financial institutions in the world. Now, JPMorgan Chase has a sorted risk management framework to identify, assess, monitor, and mitigate risks it faces in its operations.

One notable event in JPMorgan Chase’s history highlighting the importance of risk management is the London Whale trading scandal. It occurred in 2012 when Bruno Iksil, nick-named London Whale, made deviated trades with JP Morgan. The estimated trading loss of $2 billion was announced. Still, the loss amounted to more than $6 billion for JPMorgan Chase due to the size of his trades.

After the scandal, JPMorgan Chase underwent significant scrutiny and criticism for its risk management practices. In response, the company reinforced the importance of enhancing oversight, strengthening internal controls, and improving risk reporting and monitoring systems.

JPMorgan Chase’s risk management practices serve as a prominent example of how a large financial institution navigates and mitigates risks in a complex and dynamic business environment. By continuously refining its risk management processes and investing in robust risk management infrastructure, JPMorgan Chase aims to safeguard its financial stability and protect the interests of its stakeholders.

Conclusion

The data and its analysis play a crucial role in setting business strategies. It is a detailed business intelligence strategy that integrates all roles of data analytics to provide a holistic view of the organisation’s status. By combining descriptive, diagnostic, predictive, and prescriptive analytics with real-time monitoring, data visualization, and data-driven decision-making, organisations take advantage of the full potential of their data to drive business growth and innovation.